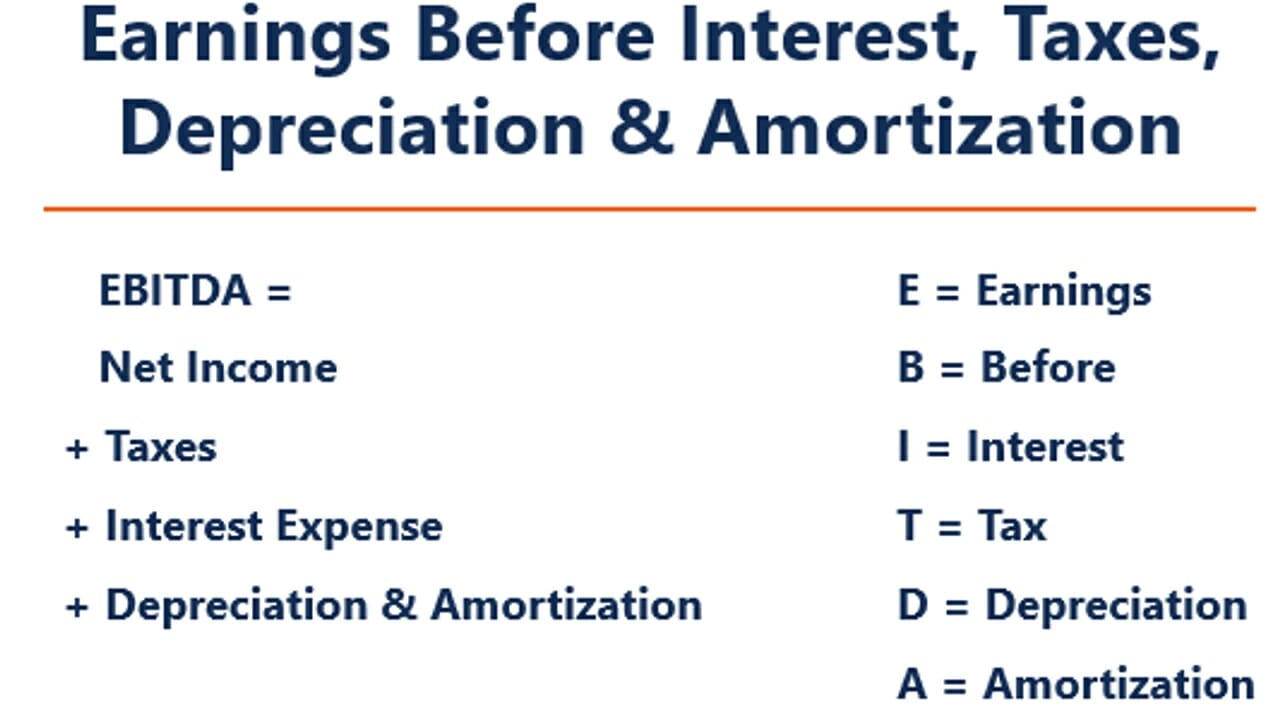

Property Taxes Ebitda . It is typically used by companies with large capital. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. It measures profitability from the core. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is the most common measure of the earnings of a company in the middle market. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. But it’s important to note that. Therefore, the ebitda equation is as follows: ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda = earnings before interest, taxes, depreciation and amortization.

from haipernews.com

ebitda = earnings before interest, taxes, depreciation and amortization. It is typically used by companies with large capital. But it’s important to note that. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. It measures profitability from the core. Therefore, the ebitda equation is as follows: ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is the most common measure of the earnings of a company in the middle market.

How To Calculate Ebitda From Tax Return Haiper

Property Taxes Ebitda It is typically used by companies with large capital. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. It is typically used by companies with large capital. But it’s important to note that. ebitda = earnings before interest, taxes, depreciation and amortization. ebitda is the most common measure of the earnings of a company in the middle market. Therefore, the ebitda equation is as follows: ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. It measures profitability from the core. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and.

From haipernews.com

How To Calculate Ebitda From Tax Return Haiper Property Taxes Ebitda ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda = earnings before interest, taxes, depreciation and amortization. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is the most common measure of the. Property Taxes Ebitda.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? Property Taxes Ebitda ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. It measures profitability from the core. ebitda is the most common measure of the earnings of a company in the middle market. ebitda =. Property Taxes Ebitda.

From brokeasshome.com

Tax Depreciation Tables Uk Property Taxes Ebitda adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. It measures profitability from the core. It is typically used by companies with large capital. Therefore, the ebitda equation is as follows: But it’s important to note that. ebitda is an acronym for earnings before interest, taxes,. Property Taxes Ebitda.

From breakingintowallstreet.com

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial Property Taxes Ebitda adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is the most common measure of the earnings of a company in the middle market. ebitda = earnings before interest,. Property Taxes Ebitda.

From www.chegg.com

Statement Balance Sheet 196,250 Sales Costs Property Taxes Ebitda ebitda = earnings before interest, taxes, depreciation and amortization. It is typically used by companies with large capital. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. Therefore, the ebitda equation is as follows: ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda. Property Taxes Ebitda.

From blnnews.com

Property Taxes Due today BlnNews Property Taxes Ebitda ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. It measures profitability from the core. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is the. Property Taxes Ebitda.

From www.cubesoftware.com

EBITDA vs. net a comprehensive tutorial Property Taxes Ebitda It is typically used by companies with large capital. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. But it’s important to note that. ebitda = earnings before interest, taxes, depreciation and amortization. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is. Property Taxes Ebitda.

From www.manaycpa.com

Understanding How Property Taxes Work A Complete Guide Manay CPA Property Taxes Ebitda ebitda is the most common measure of the earnings of a company in the middle market. It measures profitability from the core. Therefore, the ebitda equation is as follows: ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda is an acronym for earnings before interest, taxes, depreciation,. Property Taxes Ebitda.

From www.douglas.co.us

2023 Property Tax Notifications arriving now Douglas County Property Taxes Ebitda ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. It is typically used by companies with large capital. It measures profitability from the core. ebitda = earnings before interest, taxes, depreciation and amortization. But it’s important to note that. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a. Property Taxes Ebitda.

From www.chicagobusiness.com

Chicago property taxes rise nearly 7 in 2023 tax year Crain's Juice Property Taxes Ebitda It measures profitability from the core. But it’s important to note that. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda is the most common measure. Property Taxes Ebitda.

From db-excel.com

Ebitda Valuation Spreadsheet Property Taxes Ebitda Therefore, the ebitda equation is as follows: It measures profitability from the core. ebitda is the most common measure of the earnings of a company in the middle market. It is typically used by companies with large capital. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda = earnings before interest,. Property Taxes Ebitda.

From www.asimplemodel.com

Statement Overview A Simple Model Property Taxes Ebitda ebitda is the most common measure of the earnings of a company in the middle market. It measures profitability from the core. It is typically used by companies with large capital. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. Therefore, the ebitda equation is as follows: But it’s important to note that. adjusted. Property Taxes Ebitda.

From www.youtube.com

How Your Property Tax is Calculated YouTube Property Taxes Ebitda It is typically used by companies with large capital. It measures profitability from the core. ebitda is the most common measure of the earnings of a company in the middle market. ebitda = earnings before interest, taxes, depreciation and amortization. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s. Property Taxes Ebitda.

From www.upbizor.com

Cómo calcular el EBITDA, el CFO, el FCF, el FCFE, y el FCFF Property Taxes Ebitda But it’s important to note that. Therefore, the ebitda equation is as follows: adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. ebitda is the most common measure of the earnings of a company in the middle market. ebitda is “earnings before interest, taxes, depreciation,. Property Taxes Ebitda.

From taxfoundation.org

To What Extent Does Your State Rely on Property Taxes? Tax Foundation Property Taxes Ebitda ebitda = earnings before interest, taxes, depreciation and amortization. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. adjusted ebitda is a metric of a business’s earnings that starts with net income and. Property Taxes Ebitda.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Taxes Ebitda adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. Therefore, the ebitda equation is as follows: ebitda = earnings before interest, taxes, depreciation and amortization. But it’s important to note that. ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. ebitda. Property Taxes Ebitda.

From www.alpharetta.ga.us

Property Tax Bills Mailed To Residents Property Taxes Ebitda ebitda is “earnings before interest, taxes, depreciation, and amortisation.” this calculation is a measure of a company’s profits. ebitda = earnings before interest, taxes, depreciation and amortization. adjusted ebitda is a metric of a business’s earnings that starts with net income and adds back interest, taxes, depreciation, and. Therefore, the ebitda equation is as follows: It is. Property Taxes Ebitda.

From www.housingwire.com

Property taxes on singlefamily homes increase 6 in 2017 HousingWire Property Taxes Ebitda It is typically used by companies with large capital. ebitda, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of. ebitda is the most common measure of the earnings of a company in the middle market. ebitda = earnings before interest, taxes, depreciation and amortization. adjusted ebitda is a metric of a business’s. Property Taxes Ebitda.